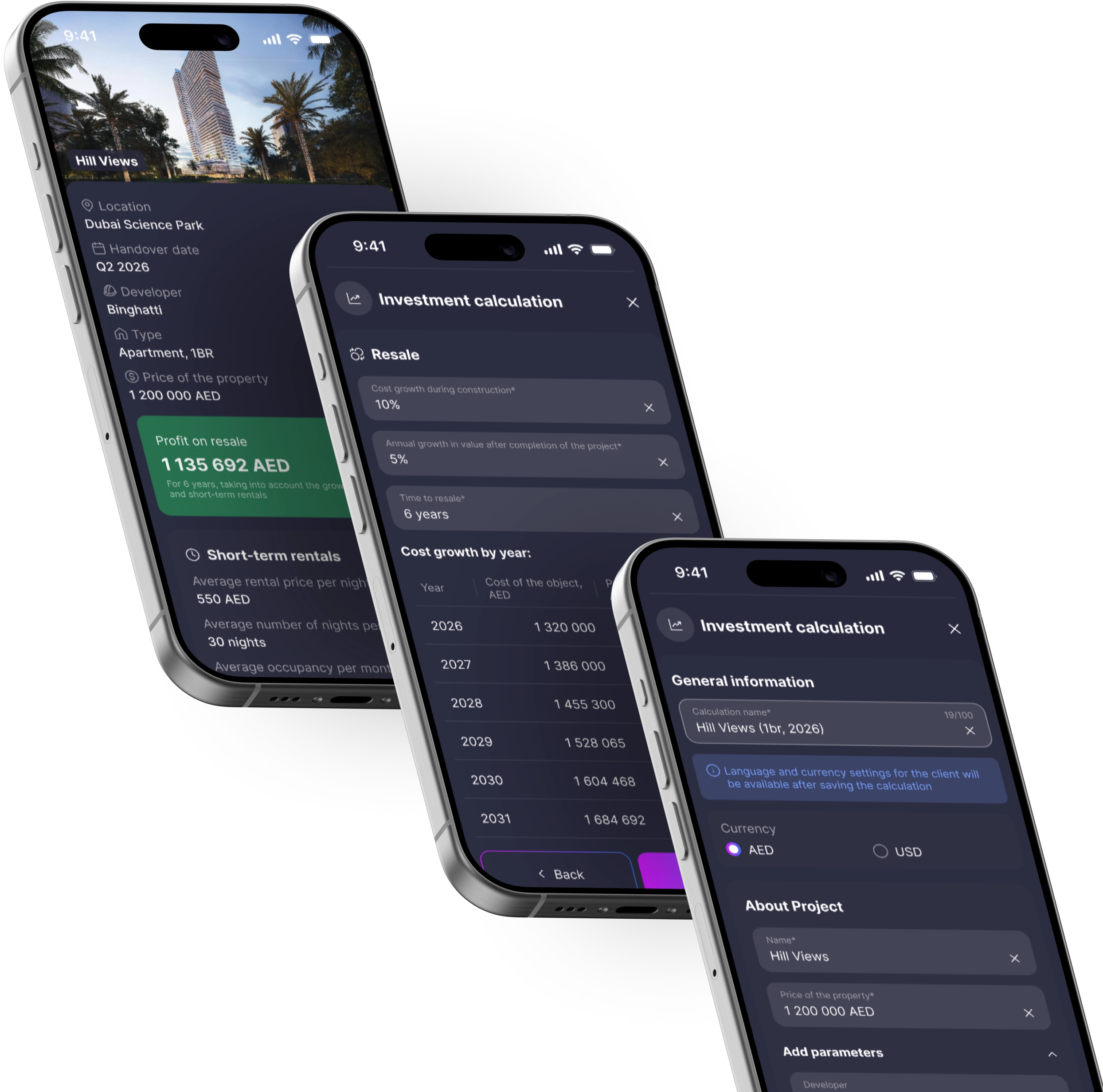

Investment Calculation

How to choose a strategy and calculate real estate returns

Often, buying real estate is not just about having a place to live but also a tool for generating income. To evaluate how profitable a deal is, it is important to calculate returns in advance, considering different strategies.

Below, we will analyze three main investment strategies:

- Short-term rental — renting out daily or for a few weeks

- Long-term rental — renting for 6–12 months

- Resale — selling the property with capital appreciation

We will detail which parameters affect income and show how to account for them in calculations

Short-term rental

- Higher returns compared to long-term rental

- Ability to use dynamic pricing (raising rates during peak season)

- Flexibility to use the property for personal purposes

- More operational workload (check-ins, cleaning, marketing)

- Higher risk of vacancies during off-season

- Dependence on booking platforms and their fees

- Average nightly rate — determined by comparable properties in the area

- Average number of nights per month — usually calculated based on 30 nights

- Average occupancy rate — number of rented nights per month (e.g., 70% = 21 nights)

- Taxes and commissions — e.g., booking platform fees

- Monthly expenses — cleaning, maintenance, service fees

- Average monthly income = nightly rate × occupancy (number of nights)

- Annual income = net monthly income × 12

- Payback period = property price ÷ annual income

- Net monthly income = monthly income – expenses

- ROI = (annual income ÷ property price) × 100%

- Property price — 1 200 000 AED

- Average nightly rate — 500 AED

- Average occupancy — 70%, 21 nights

- Monthly income = 500 × 21 = 10 500 AED

- Expenses 1 500 AED (commissions, cleaning)

- Net monthly income = 10 500 – 1 500 = 9 000 AED

- Annual income = 9 000 × 12 = 108 000 AED

- ROI = (108 000 ÷ 1 200 000) × 100% = 9%

- Payback period = 1 200 000 ÷ 108 000 ≈ 11 years

Long-term rental

- More stable and predictable income

- Less operational work compared to short-term rental

- No need for constant tenant search

- Lower returns compared to short-term rental

- Dependence on long-term market rental rates

- Possible vacancies between tenants

- Average monthly rent — market rate in the selected location

- Taxes/commission per month — agent commission on rental, VAT (if applicable), averaged monthly

- Monthly expenses — service charges, maintenance, minor repairs

- Net monthly income = rent – taxes/commission – expenses

- Annual income = net monthly income × 12

- ROI = (annual income ÷ property price) × 100%

- Payback period (years) = property price ÷ annual income

- Property price — 1 200 000 AED

- Rent — 8 000 AED/month

- Expenses — 1 000 AED/month

- Net monthly income = 8 000 – 1 000 = 7 000 AED

- Annual income = 7 000 × 12 = 84 000 AED

- ROI = (84 000 ÷ 1 200 000) × 100% = 7%

- Payback period = 1 200 000 ÷ 84 000 ≈ 14 years

Resale

This strategy can be combined with a rental approach to maximize returns

- Potential for high profits if entering at an early stage of construction or right after project completion

- No need to manage rental operations

- Returns depend on market conditions

- Capital is locked until the moment of sale

- Risks of market price declines

- Price appreciation during construction — as a % of purchase price, often higher until handover

- Time until completion — number of years or months until the property is handed over

- Annual growth after completion — projected increase in resale price on the secondary market

- Holding period until resale — how many years the property will remain in ownership

- Purchase price — 1 000 000 AED, handover in 2026

- Growth during construction — 10% (until handover), 1,200,000 AED at the time of keys

- Annual growth after handover — 5%

- Holding period until sale — 6 years after completion

| Property value, AED | Profit from sale, AED | |

|---|---|---|

| 2026 | 1,100,000 AED (+10% to the initial price) | 100,000 AED |

| 2027 | 1,155,000 AED | 155,000 AED |

| 2028 | 1,212,750 AED | 212,750 AED |

| 2029 | 1,273,388 AED | 273,388 AED |

| 2030 | 1,337,057 AED | 337,057 AED |

| 2031 | 1,403,910 AED | 403,910 AED |

Common mistakes made by brokers and buyers when calculating investment returns

- Choose your strategy — short-term rental, long-term rental, resale, or all of the above

- Enter your data

- Get a ready-made calculation of ROI, payback period, and net income — taking into account all expenses and market characteristics

- Send the calculation to the client in PDF, PNG, or web link format — beautifully structured and in a consistent style

- Track when the client has opened the calculation and return to the dialogue in a timely manner